Fintech startups operate in an ultra-competitive market where speed, compliance, and user experience dictate survival. However, burn rate—the pace at which a startup depletes its capital—can be a silent killer. Rising developer salaries in major tech hubs have made engineering talent one of the biggest expenses for early-stage fintech ventures. A McKinsey report notes that software engineering salaries in North America have grown 20% year-over-year for specialized roles like blockchain and AI engineers (McKinsey, 2023).

When every dollar matters, controlling these costs without stalling product innovation is critical. That’s where offshore software teams enter the equation.

Offshoring is no longer just about cost arbitrage—it’s a strategic talent move. Leveraging fintech engineering outsourcing enables startups to build agile global squads that work in real-time with headquarters while maintaining compliance with local regulations. Studies show distributed agile teams can achieve similar, if not better, productivity than co-located teams when structured correctly (Herbsleb & Mockus, 2003).

By tapping into offshore ecosystems in Asia, Eastern Europe, and LATAM engineering teams, fintech startups gain access to specialized talent in blockchain, payment processing, and fraud detection systems—all without draining capital reserves.

Latin America is emerging as a powerhouse for fintech talent. Countries like Brazil, Mexico, and Colombia are producing highly skilled engineers with strong English proficiency and experience in agile workflows. This proximity to U.S. time zones reduces communication friction compared to teams based in Asia (Gartner, 2022).

For fintech startups managing complex financial infrastructures, offshore software teams in LATAM offer not only affordability but also cultural alignment and regulatory awareness—both essential for industries governed by compliance standards like PCI-DSS and GDPR.

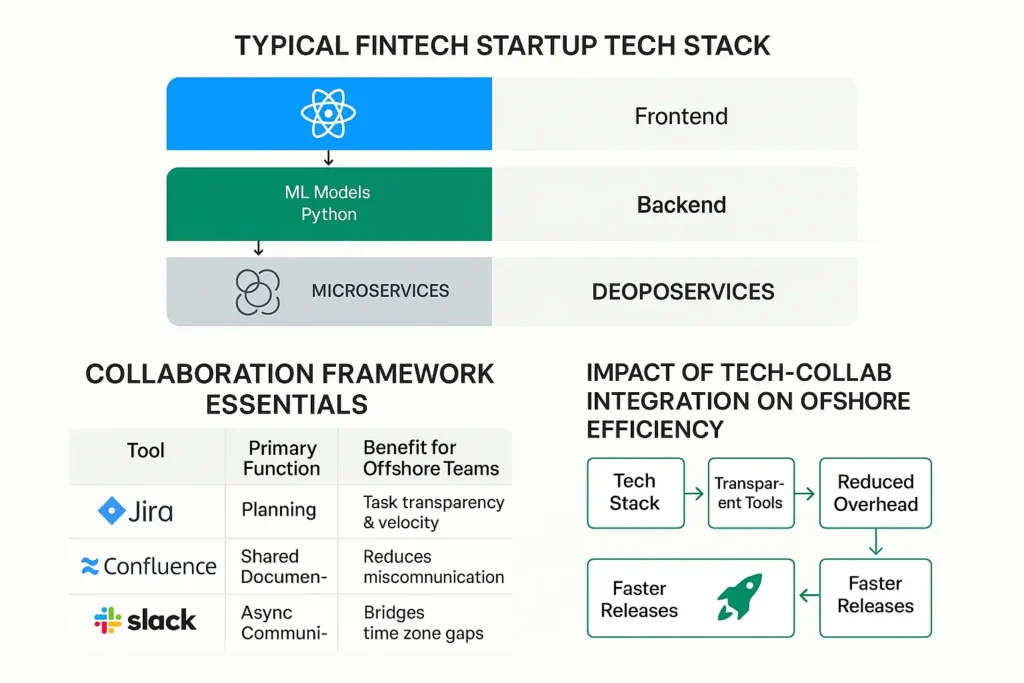

A well-defined tech stack and collaboration framework are critical for successful offshore engagements. Most fintech startups opt for microservices-based architectures with Node.js, Python (for ML models), and React for front-end development. Using DevOps pipelines with CI/CD ensures faster deployments, while tools like Jira, Confluence, and Slack enable transparent communication and sprint planning.

Research suggests that well-integrated collaboration platforms significantly reduce the coordination overhead in distributed agile teams (Hossain et al., 2009). This is crucial for fintech companies operating under strict release cycles and security compliance mandates.

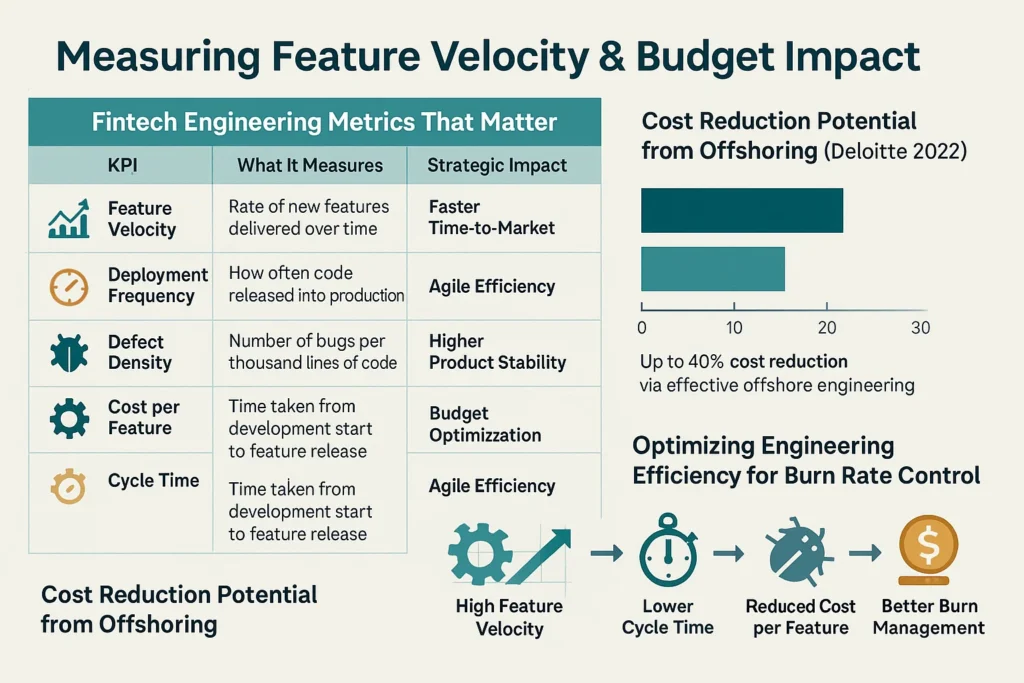

The success of fintech engineering outsourcing must be measured beyond cost savings. Metrics like feature velocity, deployment frequency, and defect density offer insights into team performance. According to a Deloitte study, companies that offshore engineering effectively can reduce development costs by up to 40% while maintaining delivery speed (Deloitte, 2022).

Moreover, using KPIs such as Cost per Feature and Cycle Time allows fintech CTOs to link engineering efficiency directly to burn rate optimization.

Resilience in remote teams hinges on strong onboarding, cultural integration, and clear documentation. Offshore squads should be treated as an extension of the core team, not as outsourced vendors. Regular knowledge-sharing sessions, virtual stand-ups, and code reviews create accountability and trust—factors critical to product security and compliance in fintech (Cusumano et al., 2021).

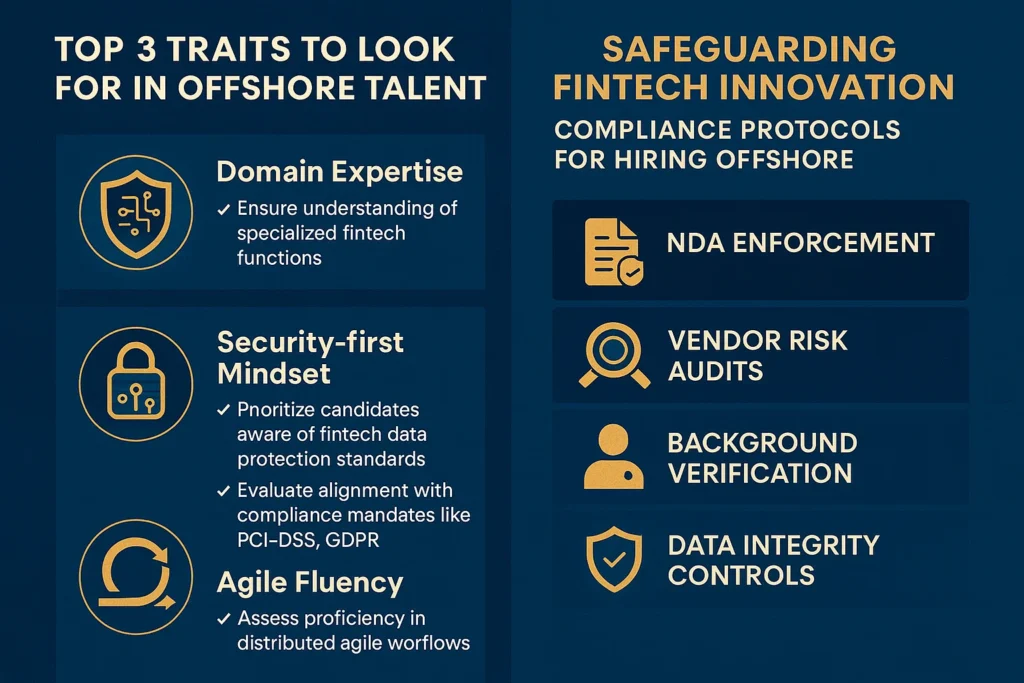

For CTOs navigating this landscape, hiring offshore talent is not just about technical skill. Key criteria include:

Companies identify what roles can be outsourced.

Companies identify what roles can be outsourced.

Companies identify what roles can be outsourced.

CTOs must ensure vendor audits, background checks, and NDAs are in place to maintain data integrity and trust.

For fintech startups under pressure to deliver innovation without burning through cash reserves, leveraging agile global squads and offshore software teams is no longer optional—it’s a growth imperative. Done strategically, fintech engineering outsourcing can deliver cost efficiency, speed, and resilience—ensuring startups stay competitive without sacrificing compliance or quality.

Herbsleb, J. D., & Mockus, A. (2003). An empirical study of speed and communication in globally distributed software development. IEEE Transactions on Software Engineering.

https://doi.org/10.1109/TSE.2003.1183142

Hossain, E., Babar, M. A., & Paik, H. Y. (2009). Using Scrum in global software development: A systematic literature review. Global Software Engineering Conference.

https://doi.org/10.1109/ICGSE.2009.25

McKinsey & Company. (2023). Tech talent trends in fintech.

https://www.mckinsey.com/business-functions/people-and-organizational-performance/our-insights/the-state-of-tech-talent

Gartner. (2022). Global outsourcing trends in financial technology.

https://www.gartner.com/en/documents/4000598

Deloitte. (2022). Cost optimization strategies in fintech engineering.

https://www2.deloitte.com/insights/us/en/industry/financial-services/fintech-trends.html

Cusumano, M. A., et al. (2021). The Business of Platforms: Strategy in the Age of Digital Competition.

https://www.hbs.edu/faculty/Pages/item.aspx?num=58355

Join thousands of businesses leveraging offshore staffing to scale their operations globally

Expand effortlessly with My Offshore Employees - access top 1% offshore talent starting at just $3/hr or $600/month per FTE. No hidden fees, no compromises on quality. Your offshore employees work exclusively for you - ensuring focus, transparency, and real-time visibility into your projects. We combine smart automation and proven industry experience to deliver higher productivity, fewer errors, and tailor-made solutions for your business growth.

© 2025. All Rights Reserved.