Insurance BPO partnerships enable carriers to offload non-core but essential tasks. Key functions include:

The U.S. insurance sector is undergoing its most profound operational shift in decades. Rising climate-related claims, evolving regulatory requirements, and a shortage of skilled underwriting professionals are creating cost and efficiency pressures across the industry. According to Deloitte, nearly 67% of insurance executives cite underwriting delays and escalating administrative costs as key operational bottlenecks (Deloitte, 2023).

Simultaneously, consumer expectations for fast policy issuance and seamless claims settlements are higher than ever. This mismatch between capacity and demand has led to the rapid adoption of Insurance Process Outsourcing (IPO)—a model where insurers partner with offshore teams for underwriting support, claims administration, and compliance functions.

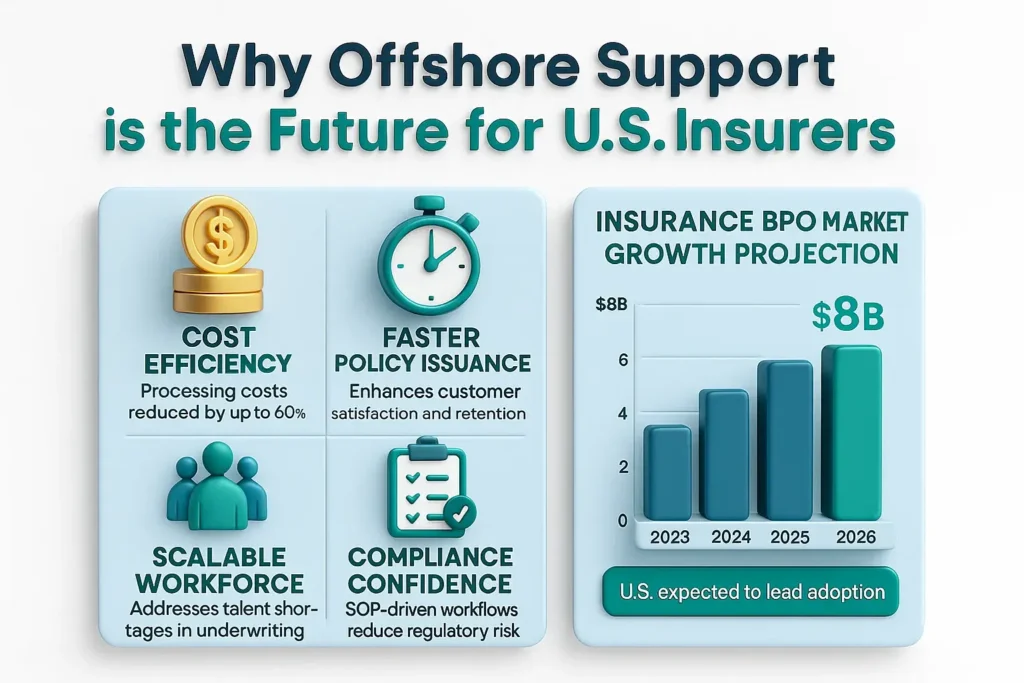

By leveraging global talent pools, insurers can reduce costs by up to 60%, accelerate decision-making, and improve operational resilience—all without sacrificing compliance or customer experience.

Traditional underwriting is a resource-heavy process involving:

With increased complexity—such as cyber insurance and climate risk coverage—manual workflows are breaking down.

Challenges U.S. carriers face include:

McKinsey estimates that labor costs represent 35% of operating expenses in P&C underwriting, a figure projected to rise unless automation and outsourcing are adopted (McKinsey, 2022).

Insurance BPO partnerships enable carriers to offload non-core but essential tasks. Key functions include:

Why offshore?

Cost reductions of 50–60% without compromising quality.

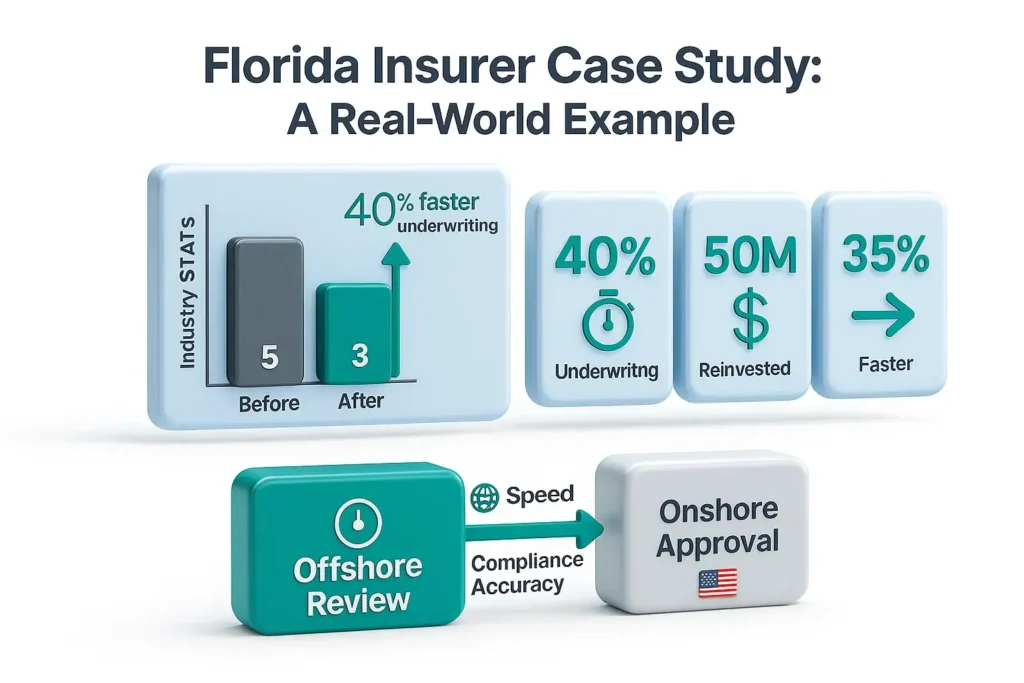

A mid-sized property insurer in Florida faced severe capacity issues during hurricane season. By partnering with an offshore BPO provider:

The insurer also leveraged dual-layer QA by combining offshore checks with onshore approvals, ensuring both speed and compliance accuracy.

Offshore teams are integrated into the insurer’s digital ecosystem through advanced tools:

PwC research shows that combining outsourcing with claims automation increases Straight-Through Processing (STP) rates to over 70%, significantly cutting cycle times (PwC, 2023).

Compliance remains the backbone of insurance operations. Offshore models must follow:

EY’s outsourcing survey highlights that 95% of insurers require offshore teams to sign NDAs, follow encrypted workflows, and undergo periodic compliance audits (EY, 2023).

Service Level Agreements (SLAs) ensure accountability and measurable outcomes:

Quality frameworks include:

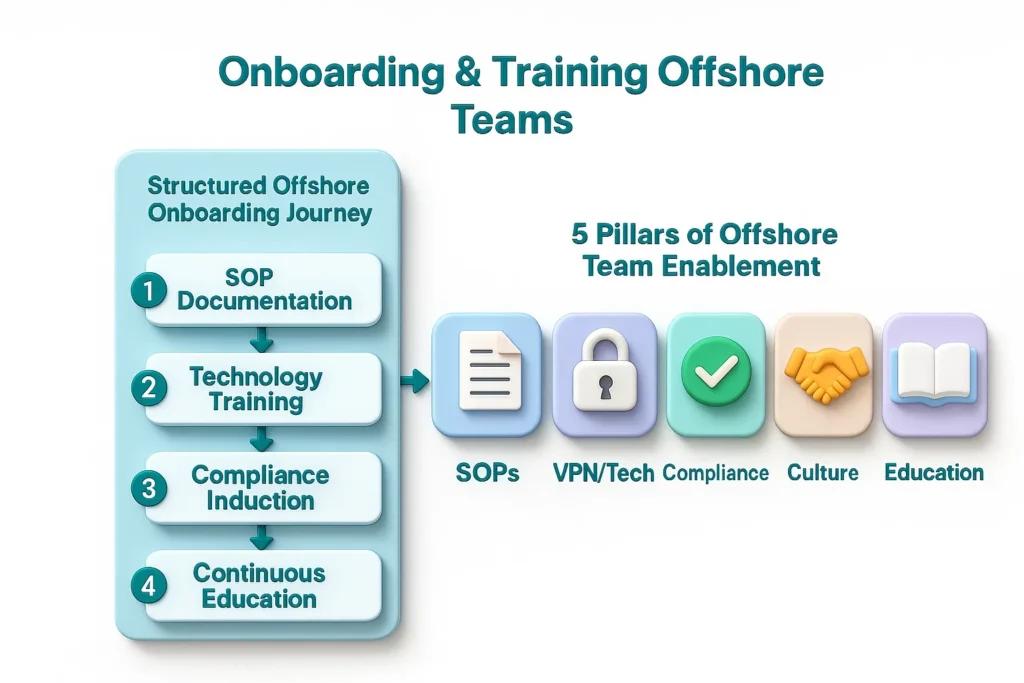

A structured onboarding program ensures seamless integration:

Clear, detailed process maps for every workflow.

Secure access via VPN; sandbox training before live operations.

U.S. state regulations, HIPAA, and NAIC compliance.

Improves collaboration between U.S. underwriters and offshore teams.

Updates on emerging regulations and underwriting best practices.

A phased implementation approach—starting with low-risk administrative tasks and gradually adding complex underwriting and claims functions—minimizes disruption.

The insurance BPO market is projected to exceed $8 billion globally by 2026, with the U.S. leading in adoption due to rising operational complexity (Statista, 2023).

Join thousands of businesses leveraging offshore staffing to scale their operations globally

Expand effortlessly with My Offshore Employees - access top 1% offshore talent starting at just $3/hr or $600/month per FTE. No hidden fees, no compromises on quality. Your offshore employees work exclusively for you - ensuring focus, transparency, and real-time visibility into your projects. We combine smart automation and proven industry experience to deliver higher productivity, fewer errors, and tailor-made solutions for your business growth.

© 2025. All Rights Reserved.